Risk report

Risk strategy

The business activities of the KION Group necessarily involve risk. Dealing responsibly with risk and managing it in a comprehensive manner is an important element of corporate management. The overarching aim is to fully harness business opportunities while ensuring that risk always remains under control. Using its groupwide risk management system, the KION Group contains all identified risks by implementing suitable measures and takes appropriate precautions. This ensures that the losses expected if these risks arise will be largely covered and therefore will not jeopardise the Company’s continuation as a going concern.

At the KION Group, risk management has always been embedded in the Accounting & Finance function and now plays an active and wide-ranging role due to the strategic focus of Accounting & Finance. The operational units’ business models, strategic perspectives and specific plans of action are examined systematically.

Principles of risk management

To ensure that the risk management systems are fully integrated into the KION Group’s overall financial planning and reporting process, they are located in the Group Accounting & Finance function.

The procedures governing the KION Group’s risk management activities are laid down in internal risk guidelines. For certain types of risk, such as financial risk or risks arising from financial services, the relevant departments also have guidelines that are specifically geared to these matters and describe how to deal with inherent risks. Risk management is organised in such a way that it directly reflects the structure of the Group itself. Consequently, risk officers supported by risk managers have been appointed for each company and each division. A central Group risk manager is responsible for the implementation of risk management processes in line with procedures throughout the Group. His or her remit includes the definition and implementation of standards to ensure that risks are captured and evaluated.

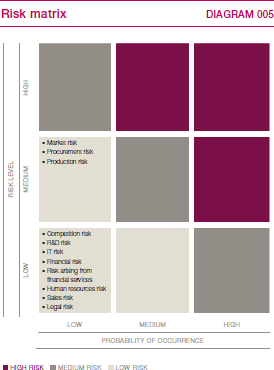

The risk management process is organised on a decentralised basis. Firstly, a groupwide risk catalogue is used to capture the risks attaching to each company. Each risk must be captured individually. If the losses caused by a specific risk or the likelihood of this risk occurring exceed a defined limit, the KION Group’s Executive Board and its Accounting & Finance function are notified immediately. Each risk is documented in an internet-based reporting system designed specifically for the requirements of risk management. Risks affecting more than one Group company, such as market risks, competition risks, financial risks and risks arising from financial services are not recorded individually but are instead evaluated at Group level. Consequently, such risks are not quantified.

The scope of consolidation for risk management purposes is the same as the scope of consolidation for the consolidated financial statements. The risks reported by the individual companies are combined to form divisional risk reports as part of a rigorous reporting process. To this end, minuted risk management meetings are held once a quarter. Moreover, material risks are discussed with the segments at the business review meetings. The divisional risk reports are then used to compile an aggregate risk portfolio for the KION Group as a whole. To support this, the relevant departments of the holding company are consulted each quarter in order to identify and assess risk – particularly Company-wide, cross-brand risk affecting areas such as treasury, purchasing, tax, human resources and financial services. The Executive Board of KION GROUP AG and the Supervisory Board’s Audit Committee are informed of the Group’s risk position once a quarter. The Internal Audit department audits the risk management system at regular intervals.

Material features of the internal control and risk management system pertaining to the (Group) accounting process

Principles

The main objectives of the special accounting-related internal control system are to avoid the risk of material misstatements in financial reporting, to identify material mismeasurement and to ensure compliance with the applicable regulations and internal instructions. This includes verifying that the consolidated financial statements and group management report comply with the relevant accounting standards. There can, however, be no absolute certainty that these objectives are achieved in full and at all times.