Macroeconomic conditions

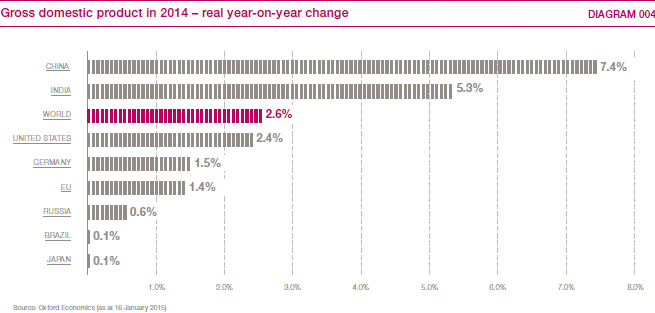

In 2014, growth in the global economy was less dynamic than anticipated, remaining almost unchanged from 2013. Adverse factors included the greater geopolitical risks caused by the conflicts in Ukraine and the Middle East, plus resurgent uncertainty in the financial markets.

Another noticeable feature was the muted growth in emerging markets, which were unable to build overall on the growth rates achieved in 2013. The weaker pace of growth in China led to a drop in demand from key trading partners, even though the shift towards a sustainable growth trajectory can be seen as a positive development over the longer term. Growth rates in the other newly industrialising countries in Asia were sound but nevertheless still down year on year on average, although India managed to increase its growth rate again.

In South America, the main factor acting as a brake on growth other than the fall in commodity prices was the political uncertainty in individual countries. Brazil, the largest economy in Latin America, entered recession in the first half of the year and ended 2014 with close to zero growth for the year as a whole. Growth across eastern Europe was uneven and overall not as strong as in 2013. The economies of Poland and the Czech Republic enjoyed growth, whereas the Russian economy contracted significantly as a consequence of the sanctions imposed in connection with the crisis in Ukraine and as a result of the steep drop in the value of the rouble and the persistently low price of oil.

On balance, the industrialised nations achieved a somewhat higher level of growth than in 2013, but likewise still fell short of expectations. Economic recovery in the eurozone was particularly disappointing with unexpectedly weak growth in Germany compounding the impact from the recession in Italy and stagnation in France. In contrast, the picture in the United Kingdom was positive, boosted by higher consumer spending and stronger growth in services, a key sector of the economy. In the US, the growth rate almost exceeded that achieved in 2013, with both consumer spending and corporate capital investment rising substantially during the course of the year.

Demand for industrial trucks is primarily driven by investment confidence and world trade volumes as well as GDP growth. The increase in spending on capital equipment was spread unevenly around the globe, reflecting the varying rates of market growth. Whereas the US saw a considerable rise in this spending, businesses in the eurozone, including Germany in particular, remained noticeably reticent. Over the whole of 2014, the expansion in global trade was weaker than anticipated and once again fell short of the long-term trend. The growth in imports and exports in the emerging markets was more subdued than in 2013.