KION shares

Strong outperformance

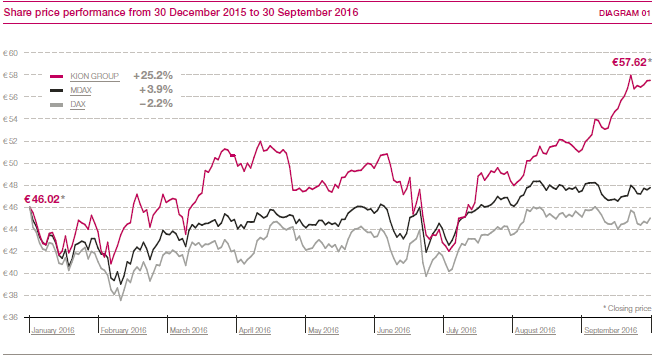

The stock markets quickly absorbed the impact of the United Kingdom’s decision to leave the European Union. In the third quarter, however, the DAX did not quite make up for all of the losses in the first half of the year and closed at 10,511 points, down by 2.2 per cent compared with the end of 2015. By contrast, the MDAX gained 3.9 per cent over the nine-month period.

KION shares rose sharply in the third quarter, significantly outperforming the benchmark indices. On 22 September 2016, the shares reached their high of the year so far of €58.09 – which was also their highest price since the IPO – and closed at €57.62 on 30 September. This was up by 25.2 per cent compared with the price at the end of 2015 of €46.02. At the end of the third quarter, market capitalisation stood at €6.3 billion, of which €3.7 billion was attributable to shares in free float. > DIAGRAM 01