KION shares

Strong growth for the equity markets in 2013

International securities markets exhibited a strong upward trend in 2013. The Euro Stoxx 50 increased from 2,636 points to 3,109 points, a gain of 18.0 per cent. The DAX was even more buoyant, rising by 25.5 per cent to 9,552 points. And the Dow Jones Industrial Index climbed by a substantial 26.5 per cent to 16,577 points.

However, there was volatility over the course of the year, primarily due to discussions and market expectations about the imminent scaling back by the Federal Reserve of its bond-buying programme, which is aimed at stimulating the economy. The Fed’s announcements that it would possibly reduce its bond buying in the short term led to turbulence in international equity markets in late June. However, this step was postponed and low interest rates and indications of an economic turnaround then boosted share prices in the second half of the year.

Strong performance of KION shares after the IPO

Although the marketing period was characterised by the difficult situation in capital markets caused by uncertainty surrounding the Fed’s bond buying, the KION Group successfully made its initial public offering (IPO) on 26 June 2013. Its shares have been listed in the Prime Standard segment of the Frankfurt Stock Exchange since 28 June 2013. >> Table 001

|

Basic information on KION shares |

>> TABLE 001 |

|

|

|

|

ISIN |

DE000KGX8881 |

|

WKN |

KGX888 |

|

Bloomberg |

KGX.GR |

|

Reuters |

KGX.DE |

|

Share type |

No-par-value shares |

|

Indices |

SDAX, MSCI Small Cap Germany |

A total of 19.8 million shares with an issue volume of €475.4 million were placed with new investors. During the stabilisation period in the 30 days after the IPO, 2.6 million of these shares were available for placement again as an over-allotment option. At the end of the stabilisation phase, the over-allotment option was exercised for 0.3 million shares, which meant that a total of 17.5 million shares remained in free float.

In the course of KION GROUP AG’s flotation, there were also two accompanying capital increases with a total volume of €446.4 million: €328.4 million to raise the shareholding of Weichai Power (Luxembourg) Holding S.à r.l. (Weichai Power) to 30.0 per cent and €118.1 million through conversion into equity of a shareholder loan of Superlift Holding S.à r.l., whose shares are held in investment funds that are advised by Kohlberg Kravis Roberts & Co. L.P. (KKR) and The Goldman Sachs Group, Inc. (Goldman Sachs). As a result of the three capital increases in connection with the IPO, the KION Group’s equity was increased by a total of €859.9 million before deduction of the directly attributable transaction costs.

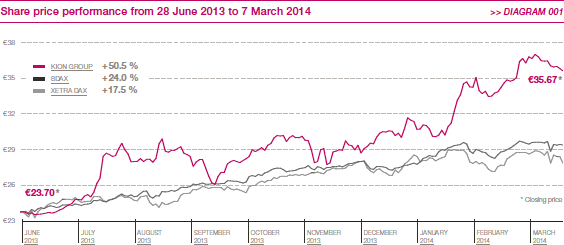

On the first day of trading on 28 June 2013, the shares began trading at €24.19 and closed at €23.70. Investors’ growing confidence in the business model of the KION Group and the general uptrend on international stock markets had a strong positive impact on the share price over the subsequent months. By the end of the year, KION shares were trading at €30.73, an increase of 29.6 per cent on the closing price on 28 June, easily outperforming the wider market over this period. Between 28 June and the end of the year, the DAX and SDAX recorded gains of 20.0 per cent and 17.1 per cent respectively. KION shares were able to carry over this strong performance into the next year, closing on 7 March 2014 at €35.67. >> Diagram 001

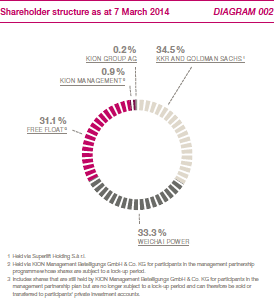

Free float has increased to 31.1 per cent since the IPO

At the end of the stabilisation phase on 27 July 2013, 17.7 per cent of KION shares were in free float. Weichai Power held 30.0 per cent of the shares, while KKR, Goldman Sachs and the KION Group’s management held the other 52.3 per cent.

The KION Group purchased a total of 200,000 treasury shares on the stock exchange between 28 August and 26 September 2013 in preparation for an employee share programme, which will be implemented during 2014. This equated to 0.2 per cent of the total number of shares.

Furthermore, many of the participants in the KION management partnership plan (MPP), which was launched for selected managers when the KION Group was sold in 2006, are now free to sell the shares held on their behalf by KION Management Beteiligungs GmbH & Co. KG (MPP KG) or to transfer them into their private investment accounts. As a result, these shares are deemed to be part of the free float. Shares held by members of the KION Executive Board and members of the Management Boards of Linde Material Handling GmbH and STILL GmbH remain subject to a lock-up period of one year following the IPO and are therefore reported as shares held by the KION Group’s management that are still held by MPP KG. Further details about the shareholdings of members of the Executive Board of KION GROUP AG can be found in the Corporate Governance Report.

Until 28 December 2013, Weichai Power had an option to acquire shares from the stake held by KKR and Goldman Sachs and thereby increase its stake from 30.0 per cent to 33.3 per cent. Weichai Power exercised this option on 18 December 2013. The shares were transferred on 15 January 2014. Since completion of this transaction there has been a mutual right of first offer between Weichai Power, on the one hand, and KKR and Goldman Sachs on the other with respect to their respective shareholdings. Weichai Power has also undertaken not to acquire more than 49.9 per cent of KION shares between now and 28 June 2018 (as part of a standstill agreement).

Between the IPO and 28 December 2013, KKR and Goldman Sachs were prohibited from selling their shares. After that date, they were free to offer their shares for sale. On 7 January 2014, KKR and Goldman Sachs placed 10.7 million shares –10.8 per cent of KION shares – on the stock exchange at a price of €29.50 per share. The placement closed within a few hours and was significantly oversubscribed. KKR and Goldman Sachs are now prohibited again from selling their shares until 7 April 2014.

Whereas 20.3 per cent of shares were in free float as at 31 December 2013, following the exercise of the option by Weichai Power and the share placement by KKR and Goldman Sachs, this figure has now risen to 31.1 per cent. KKR and Goldman Sachs remain KION GROUP AG’s largest shareholders. >> Diagram 002

SDAX inclusion

On 23 September 2013, following a periodic review of market indices, KION shares were included in the SDAX, the Deutsche Börse index of the 50 small public limited companies that follow those listed in the MDAX in terms of free-float market capitalisation and trading volume. This made KION shares attractive to a broader range of investors, because many institutional investors are predominantly interested in companies listed on an index. KION GROUP AG’s free-float market capitalisation amounted to €617.8 million as at 31 December 2013 (€1,098.3 million as at 7 March 2014). The average daily trading volume for KION shares in 2013 was 104.4 thousand shares.

Attractive dividend of €0.35 per share planned

The Executive Board and Supervisory Board of KION GROUP AG will propose a dividend of €0.35 per share to the Annual General Meeting. This equates to a dividend payout rate of 25 per cent of net income. Pro-forma earnings per share for 2013 was €1.40. >> Table 002

|

Share data |

>> TABLE 002 |

||

|

|||

|

|

|

||

|

Opening price as at 28/06/2013 |

€24.19 |

||

|

All-time high 2013 |

€31.70 |

||

|

All-time low 2013 |

€23.50 |

||

|

Closing price as at 31/12/2013 |

€30.73 |

||

|

Market capitalisation as at 31/12/2013 |

€3,038.7 million |

||

|

Performance 2013 |

29.6% |

||

|

Average daily volume 2013 in shares |

104.4 thousand |

||

|

Average daily volume 2013 in € |

€2.7 million |

||

|

Share capital |

€98,900,000 |

||

|

Shares outstanding as at 31/12/2013 |

98,900,000 |

||

|

Pro forma earnings per share 2013 |

€1.40 |

||

|

Dividend per share 2013* |

€0.35 |

||

|

Pay-out ratio* |

25% |

||

|

Total dividend payment* |

€34.5 million |

||

|

Equity ratio as at 31/12/2013 |

26.7% |

||

Majority of financial analysts recommend KION shares

Ten brokerage houses published regular studies about KION shares. Six of the analysts recommended KION shares as a buy; four rated them as neutral. The median target price specified for the shares was €37.50 as at 7 March 2014.

Greatly improved capital structure

Not only did the IPO significantly strengthen the Company’s equity base, it also greatly improved the debt structure and maturity profile. Among other things, the loans taken up in connection with the acquisition of the KION Group in 2006 were fully repaid in July 2013 using the proceeds from the IPO. Of the existing bonds due to mature in 2018, the floating-rate tranche of €175 million has also been repaid in full.

In February 2013, KION Finance S.A. issued a new bond that will mature in 2020. Of the total volume of €650 million placed, €450 million is repayable at a fixed nominal interest rate of 6.75 per cent, while €200 million carries a floating interest rate based on three-month Euribor plus 450 basis points.

The KION Group’s funding structure consists of the new bond with a volume of €650 million maturing in 2020, the fixed-rate tranche with a volume of €325 million maturing in 2018, which has an interest rate of 7.875 per cent, and a revolving credit facility (RCF) maturing in 2018. The RCF was restructured after the IPO, and up to €1,045 million can be drawn down as required.

As a result of the improved credit profile, the KION Group’s credit rating went up in July 2013. Moody’s upgraded the Corporate Family Rating by three notches, from B3/positive to Ba3/stable, while Standard & Poor’s also significantly improved its credit rating for the KION Group, from B/stable to BB–/positive.

Many voting right notifications since the IPO

Between the IPO and 7 March 2014 KION GROUP AG released 48 publications of voting rights announcements. KKR, Goldman Sachs and Weichai Power have entered into a shareholder agreement regarding the exercise of their voting rights; details of the agreement can be found in the IPO prospectus. Under this agreement, the voting rights of the three shareholders must be added together by law. This means that any securities transaction involving KION shares that Goldman Sachs carries out, in particular as lead manager or in the course of its normal banking activities, will exceed the threshold above which a voting right notification is legally required. A voting right notification is required for such transactions and it must relate to all of the voting rights held by KKR, Goldman Sachs and Weichai Power. In addition to the numerous notifications of voting rights in conjunction with the IPO and the sale of shares in January 2014, there were consequently also a number of further voting right notifications. All notifications of voting rights received and published by KION GROUP AG can be found on the Company website at kiongroup.com/ir/voting_rights_announcements.