Global economic recovery continues in 2011

The year under review saw a further recovery in the macroeconomic environment. Global gross domestic product (GDP) grew by a further 2.7 per cent following the 4.1 per cent growth achieved in 2010. Emerging markets continued to be the key growth drivers and stabilising factors in the global economy. By contrast, growth in the industrialised nations was subdued. During the course of the year, various uncertainties in international markets resulted in a slowdown in the economic upturn overall. This represented a normal cyclical pattern following the strong growth in the previous year, although there were also other temporary contributory factors, such as the sovereign debt problems in the euro zone and in the USA, the earthquake in Japan, and the sharp increase in commodity prices. In view of the sovereign debt issues, and given the slackening pace of economic growth, most industrialised countries had already switched to the pursuit of policies focusing on savings and retrenchment, with expansionary monetary policies providing further stabilisation. In 2011, significant momentum in favour of capital expenditure in the private sector also cushioned the impact from a generally weak increase in output.

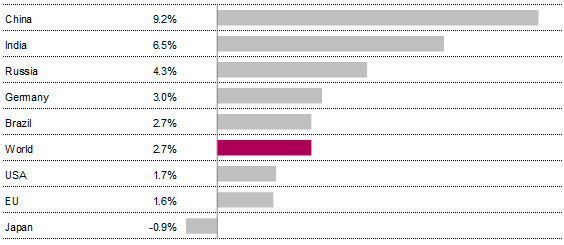

Gross Domestic Product 2011

Real change compared with the previous year

Source: Eurostat, National statistics, World Bank (Status 07.03.2012)

The impetus behind the global economy's emergence from the crisis over the last two years eased off markedly during the course of the year under review. By the end of the year, financial market data and sentiment in the economy were pointing to a significant economic slowdown. In contrast, real economic data remained overwhelmingly positive until recently. According to an assessment by the International Monetary Fund, the global economic situation will continue to be fragile in 2012, the result of flagging growth in the real economy in all regions and uncertainty regarding the funding position in public finances and financial institutions.