The KION Group, one of the world’s top two providers of industrial trucks and logistics solutions, began a new chapter in its history in the first half of 2013 when its parent company, KION GROUP AG, was successfully floated on the stock market. Proceeds from the capital increases in connection with the initial public offering (IPO) enabled the Group to significantly lower its net financial debt and lay the foundations for continuing along its successful trajectory of global growth in an attractive market environment.

The KION Group announced its intention to float on 3 June 2013 and, together with its shareholders and underwriters, published the prospectus containing the general parameters for the IPO on 14 June 2013. The price range was between € 24.00 and € 30.00 per share. At the end of the subscription period, which ran from 17 to 26 June 2013, the issue price was set at € 24.00 per share. Despite the challenging situation in the capital markets, the offering was significantly oversubscribed at the offer price. Trading began in the Frankfurt Stock Exchange’s Prime Standard segment on 28 June 2013.

Overall, 19.8 million shares with a total issue amount of € 475.4 million were placed with new investors, of which 17.2 million new shares originated from a capital increase in June 2013 (€ 413.4 million) and 2.6 million shares were from the stake held by existing shareholder Superlift Holding S.à r.l., Luxembourg, as an over-allotment (€ 61.9 million). The shares were predominantly subscribed by institutional investors from Germany, France, the United Kingdom and the United States. The underwriters were granted the option of acquiring the over-allotment shares from Superlift Holding S.à r.l., Luxembourg, at the placement price within 30 days of the start of trading. Otherwise, these shares had to be given back to Superlift Holding S.à r.l., Luxembourg, at the end of the stabilisation phase.

As part of KION GROUP AG’s flotation, two accompanying capital increases were carried out with a total volume of € 446.4 million:

- Weichai Power (Luxembourg) Holding S.à r.l., Luxembourg, a subsidiary of Weichai Power Co. Ltd., which is a strategic anchor shareholder of KION GROUP AG, acquired 13.7 million new shares at a price of € 24.00 per share immediately before the offer closed. This provided the Company with a total of approximately € 328.4 million on 27 June 2013 and 2 July 2013.

- Also before the offer closed, Superlift Holding S.à r.l., Luxembourg, whose shareholders are investment funds advised by companies in The Goldman Sachs Group, Inc. (Goldman Sachs) and companies advised by Kohlberg Kravis Roberts & Co. L.P. (KKR) or associated with KKR, acquired 4.0 million shares at a price of € 29.21 per share by way of converting an existing loan into equity and transferring the shares in Superlift Funding. This boosted equity by € 118.1 million.

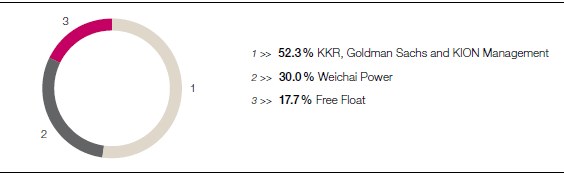

As a result of the three capital increases in connection with the IPO, the KION Group’s equity was increased by a total of € 859.9 million as at 30 June 2013 before deduction of the directly attributable transaction costs. After completion of all transactions, the share capital of KION GROUP AG stood at € 98.9 million, divided into 98.9 million no-par-value shares. Immediately after placement, 20.0 per cent of them were in free float (including the over-allotment option shares). Weichai Power holds 30.0 per cent, while 50.0 per cent is held by KKR and Goldman Sachs jointly via Superlift Holding and by the KION Group’s management. Shareholdings after the end of the stabilisation period on 26 July 2013 are shown in the diagram. >> GRAPHIC 01

On the first day of trading on 28 June 2013, KION GROUP AG shares began trading at € 24.19 and closed at € 23.70. As a result, market capitalisation amounted to € 2,343.9 million at the end of the first half of 2013.

The share price went up during July, exceeding the issue price of € 24.00. At the end of the stabilisation phase, the over-allotment option was exercised for 0.3 million shares, which therefore remained in the free float.On 6 August, the Xetra closing price was € 28.43, which was 18.5 per cent higher than the issue price. >> TABLE 01

|

Share data |

>>TABLE 01 |

|

|

|

|

Issuer |

KION GROUP AG |

|

Registered office |

Wiesbaden |

|

Commercial register no. |

HRB 27060 |

|

Share capital |

€ 98,900,000; |

|

Share class |

No-par-value shares |

|

Stock exchange |

Frankfurt Stock Exchange |

|

Market segment |

Regulated market (Prime Standard) |

|

Stock exchange symbol |

KGX |

|

ISIN |

DE000KGX8881 |

|

WKN |

KGX888 |

|

Bloomberg |

KGX GR |

|

Reuters |

KGX.DE |

|

Profit entitlement |

From 1 January 2013 |

|

First day of trading |

28 June 2013 |

|

Opening price |

€ 24.19 |

|

Closing price as at 30 June 2013 |

€ 23.70 |

|

Change compared with opening price |

-2.03 % |

|

Market capitalisation as at 30 June 2013 |

€ 2,343.9 million |

|

Pro forma earnings per share as at 30 June 2013 |

€ 0.70 |

|

Earnings per share as at 30 June 2013 |

€ 1.07 |

|

Shareholder structure (after exercise of the over-allotment option) |

>> GRAPHIC 01 |