KION shares

Strong outperformance

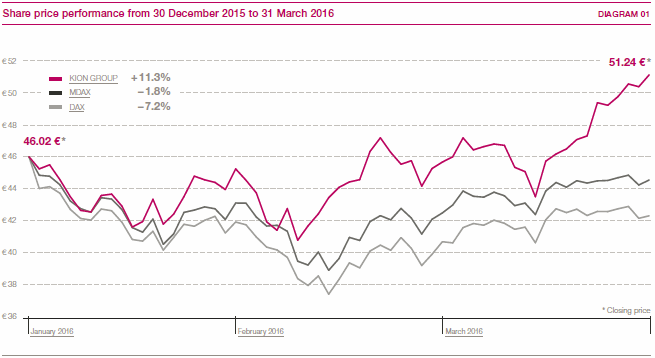

The stock markets had a volatile start to 2016. Cautious growth forecasts and an oil price that continued to decrease until mid-February triggered a sharp price correction, but prices then began to go up again. However, the DAX was unable to make up all of its initial losses and closed at 9,966 points, down by 7.2 per cent compared with the end of 2015. Despite a more positive trajectory, the MDAX also finished the quarter 1.8 per cent below its level at the end of last year.

KION shares delivered an encouraging performance in the first quarter of 2016, rising by 11.3 per cent to €51.24 (end of 2015: €46.02) and thus beating their benchmark indices. Having largely mirrored the MDAX in the first few weeks of trading and reaching their lowest price of €40.84 on 8 February, the shares then made disproportionately strong gains on the back of a positive market trend. This was due in part to the announcement of the annual results for 2015 along with the guidance ranges for 2016. The share price reached its highest point of the year so far of €51.34 on 30 March. At the end of March, market capitalisation stood at €5.1 billion, of which €3.1 billion was attributable to shares in free float. > DIAGRAM 01

Stable shareholder structure

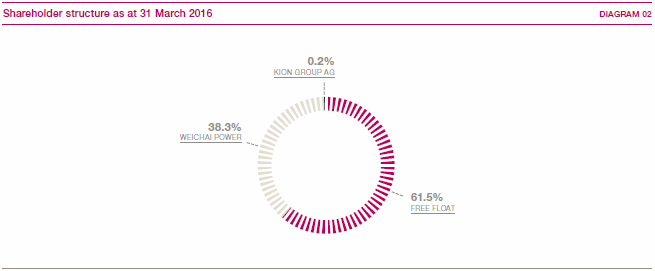

The shareholder structure remained stable in the reporting period. Weichai Power Co. Ltd. continues to be the biggest single shareholder, holding a 38.3 per cent stake in the KION Group. Weichai Power has undertaken not to acquire more than 49.9 per cent of KION shares before 28 June 2018 (as part of a standstill agreement). As had been the case at the end of 2015, KION GROUP AG held a total of 0.2 per cent of the shares at the end of the quarter. The free float thus still accounted for 61.5 per cent. > DIAGRAM 02

Comprehensive coverage

Sixteen brokerage houses currently publish regular reports on the KION Group. As at 31 March 2015, ten analysts recommended KION shares as a buy and six rated them as neutral. The median target price specified for the shares was €50.00. > TABLE 01

Share data |

01 |

||

|

|||

Issuer |

KION GROUP AG |

||

Registered office |

Wiesbaden |

||

Share capital |

€98,900,000; divided into 98,900,000 no-par-value shares |

||

Share class |

No-par-value shares |

||

Stock exchange |

Frankfurt Stock Exchange |

||

Market segment |

Regulated market (Prime Standard) |

||

Index membership |

MDAX, STOXX Europe 600, FTSE Euro Mid, MSCI Germany Small Cap |

||

Stock exchange symbol |

KGX |

||

ISIN |

DE000KGX8881 |

||

WKN |

KGX888 |

||

Bloomberg / Reuters |

KGX:GR / KGX.DE |

||

Closing price as at 31/03/2016 |

€51.24 |

||

Performance since beginning of 2016 |

11.3% |

||

Market capitalisation as at 31/03/2016 |

€5,067.6 million |

||

Free float |

61.5% |

||

Earnings per share* |

€0.33 |

||

Financing structure successfully renewed

The fixed-rate (6.75 per cent) tranche of the bond issued in February 2013, which had a volume of €450.0 million, was repaid in full ahead of schedule on 15 February 2016. The amounts drawn under the revolving credit facility dating from the time of the IPO and the bond were repaid using funds from a new syndicated loan totalling €1.5 billion, which has been taken out on terms with investment-grade-style features. The new funding significantly reduces interest expenses and provides KION Group with considerable flexibility for continuing with its strategy of profitable growth.

Two rating agencies publish credit ratings on the KION Group. The rating awarded by Standard & Poor’s for the KION Group has remained at BB+ with a stable outlook since April 2015. In April 2016, Moody’s raised its rating from Ba2 with a positive outlook to Ba1 with a stable outlook.