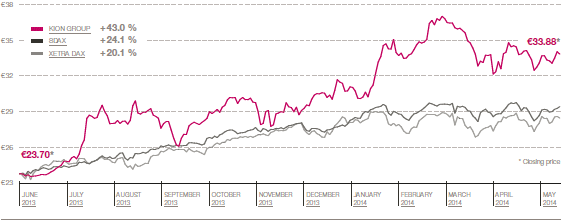

Share performance

Despite what were at times volatile conditions on the stock market, KION shares performed well in the first three months of 2014. They closed at €34.03 on 31 March 2014, which was up by around 10.8 per cent on their 2013 year-end closing price of €30.73. The shares therefore fared better than the SDAX, which rose by 5.6 per cent over the same period. They also outperformed the MDAX and DAX. They reached their lowest price of the year so far (€30.10) on 9 January 2014, while on 24 February 2014 they reached €37.07, their highest price since the IPO.

This strong performance has continued into the second quarter. On 2 May 2014, KION shares were priced at €33.88 and had therefore gained 43.0 per cent compared with the issue price on 28 June 2013. >> DIAGRAM 01

| Share price performance from 28 June 2013 to 2 May 2014 | >> DIAGRAM 01 |

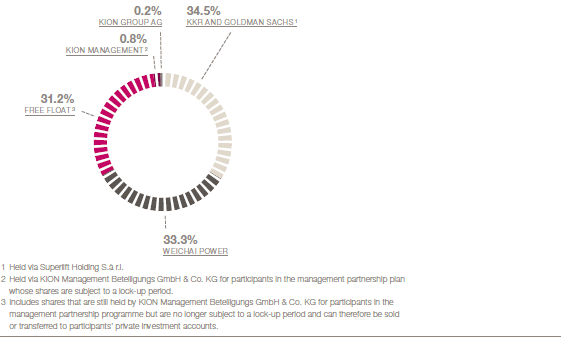

Shareholder structure

With market capitalisation of €3.4 billion and an average daily trading volume of 104.3 thousand shares – or €3.5 million – in the quarter under review, KION shares are ranked 43rd and 53rd respectively based on the criteria for inclusion in the MDAX (free float market capitalisation and trading volume).

There were changes to the shareholder structure in the first quarter of 2014. Weichai Power exercised its option to acquire shares from KKR and Goldman Sachs and thereby increase its stake from 30.0 per cent to 33.3 per cent. Since completion of this transaction on 15 January 2014, there has been a mutual right of first offer between Weichai Power on the one hand and KKR and Goldman Sachs on the other with respect to their shareholdings. Weichai Power has also undertaken not to acquire more than 49.9 per cent of KION shares between now and 28 June 2018 (as part of a standstill agreement). On 7 January 2014, KKR and Goldman Sachs placed a total of 10.7 million shares – 10.8 per cent of KION shares – on the stock exchange at a price of €29.50 per share. The placement closed within a few hours and was significantly oversubscribed. Whereas 20.3 per cent of shares were in free float as at 31 December 2013, following the exercise of the option by Weichai Power and the share placement by KKR and Goldman Sachs, this figure has now risen to 31.2 per cent. >> DIAGRAM 02

| Shareholder structure as at 2 May 2014 | >> DIAGRAM 02 |

Dividend and 2014 Annual General Meeting

The Executive Board and Supervisory Board of KION GROUP AG will propose a dividend of €0.35 per share to the Annual General Meeting on 19 May 2014. This equates to a dividend payout rate of 25 per cent of net income. Over the coming years, the KION Group plans to progressively increase its dividend payout rate from 25 per cent to roughly 35 per cent. Other agenda items will include approval of the Executive Board remuneration system and the creation of authorised and conditional capital – equating in total to 10 per cent of the existing share capital – with the option of excluding pre-emptive rights. The speeches of the Chief Executive Officer and the chairman of the Supervisory Board will be broadcast live on our website at kiongroup.com/agm. A webcast of the Chief Executive Officer’s speech will also be available on our website after the meeting.

Investor relations

The main investor relations activity was a conference call that was held when the 2013 annual report was published on 20 March 2014. The key aspects of the KION Group Strategy 2020 were presented during this event. In addition, the Company appeared at investor conferences in the first quarter, such as the Unicredit German Corporate Conference, Commerzbank German Investment Seminar and Bank of America Merrill Lynch Global Industrial & EU Auto Conference. A number of roadshows and countless one-on-one meetings with analysts and institutional investors also took place.

10 brokerage houses published regular studies about KION shares. 6 analysts recommended KION shares as a buy; 4 rated them as neutral. The median target price specified for the shares was €37.50 as at 2 May 2014.

Corporate bonds and credit rating

The amount of the outstanding bonds was reduced by a total of €525.0 million to €450.0 million on 15 April 2014. In detail, this meant that the fixed-rate tranche of the corporate bond issued in 2011, which was due to mature in 2018 and had a volume of €325.0 million, and the floating-rate tranche of the corporate bond issued in 2013, which was due to mature in 2020 and had a volume of €200.0 million, were repaid early in full. Repayment of these bonds, which had been issued before the IPO, was financed by drawdowns from the existing revolving credit facility and an extension to the credit facility of €198.0 million. The fixed-rate (6.75 per cent) tranche of the bond issued in 2013, which has a volume of €450.0 million and a maturity date of 2020, remains in place. On 7 April 2014, Moody’s raised the rating of the KION Group and the bonds from Ba3 to Ba2 with a stable outlook. Then on 15 April 2014, S&P raised its rating for the KION Group from BB– with a positive outlook to BB, still with a positive outlook. >> TABLE 01

|

Share data |

>>TABLE 01 |

||

|

|||

|

|

|

||

|

Issuer |

KION GROUP AG |

||

|

Registered office |

Wiesbaden |

||

|

Share capital |

€98,900,000; divided into 98,900,000 no-par-value shares |

||

|

Share class |

No-par-value shares |

||

|

Stock exchange |

Frankfurt Stock Exchange |

||

|

Market segment |

Regulated market (Prime Standard) |

||

|

Index |

SDAX, MSCI Small Cap Germany |

||

|

Stock exchange symbol |

KGX |

||

|

ISIN |

DE000KGX8881 |

||

|

WKN |

KGX888 |

||

|

Bloomberg / Reuters |

KGX GR / KGX.DE |

||

|

Profit entitlement |

From 1 January 2013 |

||

|

Closing price as at 31/03/2014 |

€34.03 |

||

|

Performance since beginning of 2014 |

10.8% |

||

|

Market capitalisation as at 31/03/2014 |

€3,365.6 million |

||

|

Free float |

31.2% |

||

|

Pro forma earnings per share based on 98.9 million no-par-value shares* |

€0.28 |

||

|

Earnings per share* |

€0.28 |

||