In April 2011 KION issued its first secured corporate bond, thereby opening up access to the international capital markets and diversifying its investor base. With a maturity date of 2018 and a total volume of €500 million, the bond was issued in a tranche of €325 million at a fixed interest rate and in a tranche of €175 million at a floating interest rate. It is listed on the Luxembourg stock exchange. The coupon on the fixed-interest tranche (ISIN XS0616432224) is 7.875 per cent. The floating-rate tranche (ISIN XS0616442298) is 425 basis points above the prevailing three-month EURIBOR rate, which equated to an average interest rate of 5.0 per cent over the reporting period.

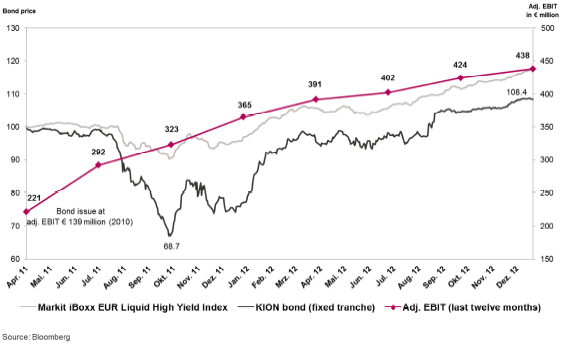

Bond performance since issue in April 2011

Having been rather subdued in 2011, the market for corporate bonds was generally very popular in 2012. Market growth also benefited the performance of the two KION tranches, which completely made up for the falls in price seen during the previous year. As a result, the increase generated in 2012 was sharper than that of the benchmark index, the iBoxx. This was certainly also due to KION's strong operational performance, as reflected in the adjusted annualised EBIT, which benefited the bond prices.

Since issuing the bond, KION has established relationships based on transparent communications with financial analysts and investors specialising in high-yield bonds and has integrated them in its regular capital market communications as part of its investor relations activities. Another important aspect of this work was the cooperation with the rating agencies Standard & Poor’s (S&P) and Moody’s Investors Service (Moody’s), which have rated KION since the bond issue. The credit ratings awarded did not change in 2012: the KION Group's rating was B3/stable (Moody’s) and B/stable (S&P), while the bond's was B2 (Moody’s) and B (S&P).

During the new financial year, Moody’s raised its rating outlook for the KION Group from stable to positive. At the same time, the very successful placement of an additional corporate bond has also confirmed KION’s good standing with bond investors (see ‘Events after the balance sheet date’).